are political contributions tax deductible for corporations

Qualification and registration fees for primaries as well as a legal expenses related to a candidacy are not deductible either. The answer is no political contributions are not tax deductible.

Are Political Contributions Tax Deductible Anedot

Posted on Jul 26 2009 Usually theyre not deductible.

. Political contributions arent tax deductible. Attempt to influence the general public or segments of the public. You can obtain these publications free of charge by calling 800-829-3676.

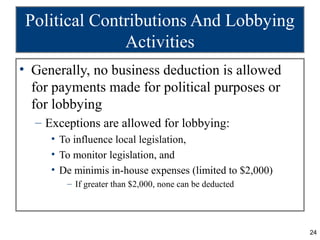

The agency also bans businesses from deducting political expenses. Generally donations to these entities are used for advocacy but not direct electoral purposes where youre asking someone to support or oppose an issue. The election of a person is a federal state or local one.

Each year you can claim up to 650 in tax-free income. Required electronic filing by tax-exempt political organizations. Corporations may deduct up to 25 of taxable income up from the previous limit of 10.

So if you happen to be one of the many people donating to political candidates campaign funds dont expect to deduct any of those contributions on your next tax return. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized. And the same goes for a.

If you own a business you understandably have a. What charitable contributions are tax deductible in 2020. Participate or intervene in any political campaign for or against any candidate for public office.

For amounts over 750 33 will be charged. A tax deduction allows a person to reduce their income as a result of certain expenses. The new deduction is for gifts that go to a public.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Contributions made by businesses and other payments you receive on a tax return cannot be deducted. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. These organizations do not have contribution limits and donors do not need to be disclosed publicly. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years beginning after July 1 2019.

Donations to this entity are not tax deductible though. In each 400 contribution between 400 and 750 50 percent gets refunded. Individuals can elect to deduct donations up to 100 of their 2020 AGI up from 60 previously.

1162-29 to the extent it seeks to influence legislation. The Taxpayer First Act Pub. Examples include expenditures to.

You cannot deduct expenses in support of any candidate running for any office even if you are spending money on your own campaign. Most political contributions whether local regional or national are not tax deductible and havent been for years. An expenditure is nondeductible under Treas.

Are Political Contributions Tax Deductible For Businesses. Some contributions can be made to the educational arm of a political organization when those arms are qualified under IRS Code section 501 c 3 or 4. You can only claim deductions for contributions made to qualifying organizations.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162 a of the internal revenue code of 1954. Are political party memberships tax deductible. For more information on the Political Contributions Tax Credit please refer to Section 47 of the Income Tax Act 2000.

The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. It is necessary to receive an official contribution receipt in order to claim your political contribution. Are Political Contributions Tax Deductible For Corporations.

Among other provisions this legislation specifically amended IRC Section 527 j to require the e-filing of Form 8872 Political. There are five types of deductions for individuals. Political contributions deductible status is a myth.

And if you check the box when filling out your tax return that asks if you want to give 3 to the Presidential Election Campaign Fund that isnt deductible either. The simple answer to whether or not political donations are tax deductible is no However there are still ways to donate and plenty of people have been taking advantage of. Its Written Into the Tax Code The Internal Revenue Service IRS also specifically says political contributions cannot be treated as deductions on individual tax returns.

In the first 400 that you contribute 75 percent gets refunded. Any such contributions made by national banks and federally chartered corporations cant be traced back to the United States. Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns.

But contributions to candidates and parties arent deductible no matter who makes them. Official receipts for political contributions must accompany the corporations T2 Corporation Income Tax Return.

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible H R Block

Electoral Bonds For Political Donations Likely To Fail The Tax Test Business Standard News

Corporate Lobbying And Political Contributions And Their Effects On Tax Avoidance Romero 2019 Journal Of Public Affairs Wiley Online Library

A Case For A Refundable Federal Political Contributions Tax Credit Ottawa Law Review

Are Your Political Contributions Tax Deductible Taxact Blog

Chapter 5 Corporate Operations Ppt Download

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Free Political Campaign Donation Receipt Word Pdf Eforms

Tax Bill Could Make Dark Money Political Contributions Tax Deductible Cnn Politics

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Smartasset

How To Reduce My Personal Income Tax Irpf In 2019

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Chapter 5 Taxable Income From Business Operations Mcgraw Hill Irwin Ppt Download